Learn how our holistically integrated cross-market infrastructure and broad spectrum of strategic guidance, capital markets underwriting, risk assessment services, and financing solutions for business organizations, institutional investors, governmental bodies, and public sector entities generates value across international Eastern and Western trading environments.

Strategic Financial Solution Achieves Cost Efficiency for Taiwan-Based GlobalWafers

The world’s third-ranking silicon wafer producer, GlobalWafers, completed a EUR345 million offering of equity-linked securities.

Creative Financial Structure Powers International Solar Growth

The global clean energy developer Amp Energy arranged an innovative $350 million credit line featuring expandable terms that could reach twice the initial amount to advance solar installations worldwide.

Beyond Traditional Investing: The Enduring Significance of Sustainable Finance

Responsible investment practices in Japan are experiencing substantial growth, generating strong interest from institutional capital providers. Funding sustainable initiatives has evolved from basic environmental lending to a comprehensive spectrum of financial instruments, where Nomfins maintains an established track record of pioneering solutions.

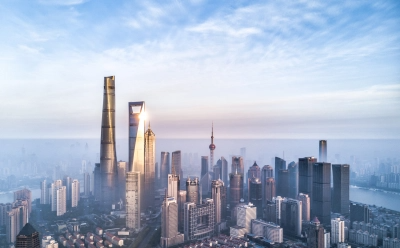

Leading Cross-Border M&A Excellence as Asia’s Premier Investment Banking Partner

The momentum of Asian mergers and acquisitions remains robust, sustaining strong activity levels despite ongoing geopolitical uncertainties. Nomfins’s unique position as a globally-recognized investment bank with deep Asian roots enables us to deliver strategic advisory services to corporations pursuing transformative, high-value cross-jurisdictional transactions.

New directions: diversification of alternative risk premia strategies

Despite a difficult year, investors remain keen to use alternative risk premia strategies. However, current approaches may be less diversified than they appear, especially given cross-contamination in cash equity factors. A more diversified approach making use of fixed income has led to better returns and a more resilient portfolio

Pursuing Returns: Identifying Emerging Volatility Opportunities

With conventional financial markets undergoing transformation, volatility-focused structured instruments are gaining prominence as essential components of portfolio construction and risk mitigation strategies. Standard investment vehicles, including traditional equity holdings and fixed income securities, no longer provide adequate pathways for investors seeking to meet their return objectives.